Golden handcuffs keep you working for a company in exchange for possibly cashing in on these options that might one day be worth a significant amount — but that value could also be lost in various ways, including by you leaving the company.

How Do Non-Qualified Stock Options Work?

Non-qualified stock options are issued at a grant price. The grant price is the price at which you can buy the company stock. If the current market price exceeds the grant price, the non-qualified stock option has value.

Here’s where the handcuffs come in: your employer may not allow you to tap this value for years. Your options come with a vesting schedule. During the time between the grant date of your options and the day they vest, you can’t exercise your option (generally speaking).

If your non-qualified stock options have value but aren’t yet vested, and considering the fact that if you leave the company you forfeit them, you can see where you might be more inclined not to leave your company until you at least get a chance to exercise.

Who would walk away from potential substantial value?

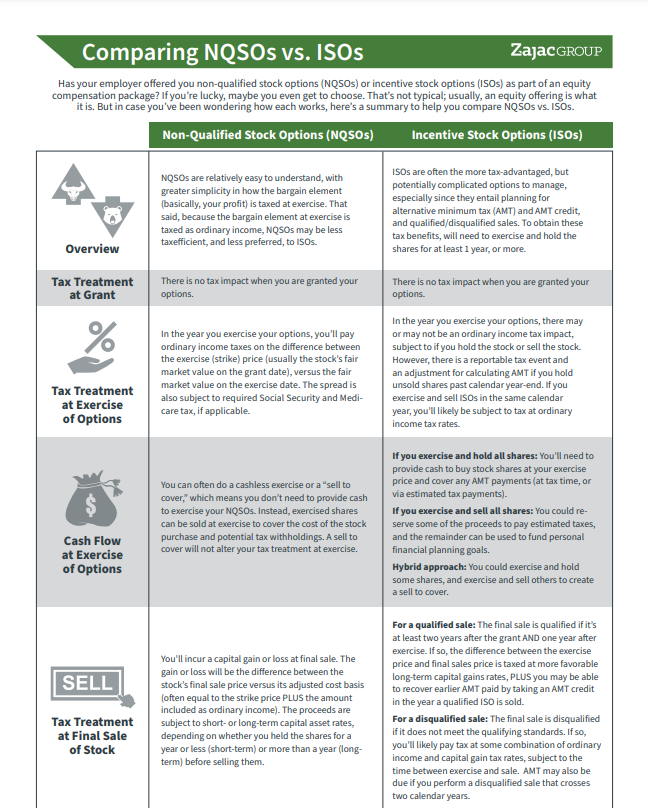

NQSOs vs. ISOs

This summary will break down the differences in how they work and what you should consider.

But let’s say your stock options have vested and you can exercise. You likely want to take action — but when you do, you need to decide how you want to cover the costs of the exercise and any taxes triggered.

While not a complete list of things to consider, here are 3 broad strategies for exercising non-qualified stock options that you may want to explore.

1: Exercise and Sell When Your Non-Qualified Stock Options Vest

The vest date is when you (the stock option holder) have the right to exercise non-qualified stock options. Prior to this vesting date, you may not be able to do anything.

Once your options vest, the first strategy you could use is to exercise and sell immediately (assuming the options are “in the money,” meaning the exercise price is less than the current market value of the stock).

The goal here is to capture the stock option value immediately and avoid both market risk and concentration risk. Often, the proceeds are then allocated to a diversified investment portfolio* (or some other personal need).

With this strategy, it’s like treating your options as additional compensation. You don’t wait and see if the stock price appreciates or extend your holding period. The point is to sell and diversify as soon as possible.

Let’s assume you have 1,000 stock options issued with a grant price of $20 per share. When they vest, let’s say the stock price is $50 per share — meaning you’d make an immediate $30 profit if you exercised and sold. That equates to a total gain of $30,000 ($30 per share multiplied by 1,000 shares).

If the stock price appreciates later, anyone who already sold and diversified lost out on the opportunity — but they also avoided the risk of the stock price depreciating in value.

And, as any other compensation, that $30,000 will be taxed as such and needs to be claimed on your tax return in the year you exercise. Specifically, the gain from NSOs is taxed as ordinary income subject to Social Security and Medicare tax.

Once you take taxes into account, you can transfer your profits to a more diversified investment portfolio.

2: Exercise and Sell at Expiration

Your non-qualified stock options don’t just have a vesting date. They have an expiration date, too.

An expiration date is the date at which the shares and any subsequent value disappear, assuming that no other action is taken.

If the current market value of the stock is lower than the grant price, then the non-qualified stock options will expire as worthless. If the current market price is in excess of the grant price, then the stock options have value.

Should you let options that have value expire, you are effectively throwing money out the door.

You might want to wait until (or near) the expiration date to make a decision. This may be because you think that the stock price will continue to go up, you may be looking to defer tax, you may be trying to utilize the leverage of stock options, or you may find not making a decision to exercise is far easier than making a choice and acting on it.

Whatever your reason for waiting, know that delaying the exercise of your non-qualified stock options until expiration may be the best bet.

If anything, delaying until expiration provides the most certainty as to what you will realize when you take action. You will know because the use it or loss it risk of not exercising (and losing the option to expiration) means that you can get X profit now, or nothing tomorrow.

If we extend the example above, let’s assume that the expiration date is several years after the vesting date and the stock price has further appreciated to $100 per share. Let’s also assume the shares will expire tomorrow.

In this scenario, you can elect to exercise the shares for a quick profit of $80 per share X 1,000 shares, of $80,000, or pass this by and have nothing tomorrow.

Clearly, the going solution seems to be an exercise.

3: Exercise at Vest and Then Hold

In lieu of exercising and selling immediately or exercising upon expiration when there is no better option, another more aggressive strategy might be to exercise your options at the vest date — and then hold the shares to take advantage of long-term capital gains tax rates.

Using the scenario above, let’s assume that you exercise your options on the vest date and claim $30,000 of income that will be taxed at ordinary income rates (the difference between a grant price of $20 and an exercise price of $50, times 1,000 shares).

Assuming a 33% bracket, the tax due on this exercise will be $9,900.

If you exercise and hold, you will begin the stock holding period for long term capital gains treatment, and the stock will have a cost basis of $50,000. After a 1-year holding period, any gain on a future stock sale will be taxed as a long-term capital gain which offers a lower tax rate.

Let’s further assume that the value of the stock will grow to $100,000 and be sold. Assuming you held the stock after exercising for the requisite 1 year period, the additional $50,000 gain will be taxed at long-term capital gains rates.

Assuming a 15% tax bracket, the tax due will be $7,500. In total, this transaction will cost $17,400 in taxes.

If we compare the tax impact of strategy 3 to the tax impact of strategy 2 above, we can illustrate the potential advantage of and early exercise and hold. The gain for strategy 2 above is $80,000, all taxed as ordinary income. Assuming a flat 33% rate, the total tax will be $26,400.

Comparing the two, Strategy 3 cost $17,400 in tax. Strategy 2 cost $26,400, or $9,000 more.

While less tax may be a good thing, there’s a trade-off: you take on additional risk by hanging onto your shares after exercising your options. Specifically, you risk losing the money it cost to exercise and buy the shares and exercise and pay the tax.

Should the stock depreciate in value after exercise, you will have paid tax on a higher amount than had you simply held the option and not exercised.

So while on paper the exercise early and hold strategy may make sense, it is one that should be considered against other possible planning needs, as well as the option of keeping your options and buying addition shares outright.

Which Strategy Is Best for Your Non-Qualified Stock Options?

No one strategy is best for everyone. Some employees choose to diversify immediately, while others wait until expiration.

Along with the strategies listed here, you also need to consider when you expect to receive options in the future (if you receive additional options to what you already have).

For example, if you expect to receive options annually, you may be more inclined to sell your shares immediately and diversify. Why? Because you may be able to participate in the upside of the company through future options, as opposed to the ones you can exercise now.

In addition to thinking through what future options receipts will look like, you need to take your overall goals, needs, and circumstances into account to determine the right choice to make with your non-qualified stock options.

This is especially true as the value of your stock options becomes a substantial portion of your net worth. Sometimes, when you have enough, you have enough.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. Hypothetical examples contained herein are for illustrative purposes only and do not reflect, nor attempt to predict, actual results of any investment. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

0 Comments

Trackbacks/Pingbacks