Many people default to a cashless exercise for a few reasons. For one, a cashless exercise is an easy option with no out-of-pocket cost. You pay for the costs of exercising your non-qualified stock options with some or all of the exercised shares themselves.

The end result of a cashless transaction is that you end up owning fewer shares of stock than would you had you done a cash exercise — which might be favorable because it gives you an opportunity to be more diversified with how you hold your assets.

Cashless exercises are easy — but are they always the best option? Let’s look at the math to decide.

Why Do a Cashless Exercise of Non-Qualified Stock Options?

The are several reasons to choose a cashless exercise over a cash exercise. One big reason may be cashflow.

Exercising your non-qualified stock options can be expensive. If you don’t have cash (or other assets) to liquid to cover the cost, you may not have a choice but to do a cashless exercise. With a cashless exercise of non-qualified stock options, you use a portion of your exercised shares to offset the cost. The cost may include buying the shares at the exercise price, the income tax due, or both.

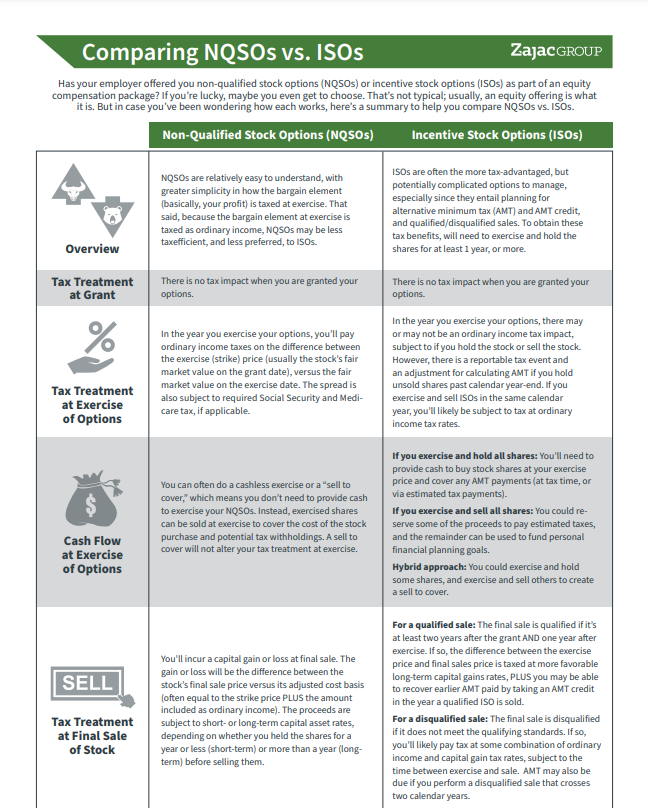

NQSOs vs. ISOs

This summary will break down the differences in how they work and what you should consider.

A cashless exercise may mean that you sell-to-cover, which means you sell enough shares to cover the cost of the exercise and the cost of the income tax due (or any combination of this), or it may mean a same-day sale that means you sell all the shares you exercise at the same time.

You may also want to sell some of your options immediately to limit your stock exposure, decrease your concentration risk, and diversify. This makes a cashless exercise a potentially good choice, even if you have the money available to cover the cost of a cash exercise.

That explains what a cashless exercise is and why you might do one. But how does it actually work?

What Happens When You Do a Cashless Exercise of Non-Qualified Stock Options?

Let’s assume that you are granted the following non-qualified stock options that you wish to exercise.

| Option Type |

Options Exercised |

Strike Price |

Fair Market Value at Exercise |

| Non-Qualified |

1,000 |

$20.00 |

$80.00 |

In this example, you have the right to buy 1,000 shares of stock at $20.00 per share, for a total purchase cost of $20,000.

These same options that you can exercise and pay $20,000 to buy are currently worth $80,000 on the open market. This provides you with a gain of $60,000.

This grant of non-qualified stock options is “in the money,” meaning they have real value. Unfortunately, these in-the-money stock options are not free to exercise.

When you exercise your option, you buy shares of stock at the strike price of the option, and you create a taxable event. The cost of the shares and the taxable event will need to be covered at exercise. A cashless exercise of non-qualified stock options covers that cost by selling off some of your shares. In this example, this is often referred to as a sell to cover.

The specific costs are as follows:

- The cost of buying the original shares at the strike price of $20 per share, multiplied by the number of options you exercise

- The income/wage and any taxes associated with exercising the non-qualified stock options

The Math Behind a Cashless Exercise of Non-Qualified Stock Options

To determine how many shares you must immediately exercise and sell, you can follow the steps and the math below:

- Calculate the cost of buying the shares: In our example above, the number of options exercised times the strike price equals the cost of buying the shares.

1,000 X $20.00 = $20,000

- Calculate the income tax due upon exercise: This calculation starts by determining the taxable amount of the exercise. The taxable amount is equal to the number of options exercised multiplied by the difference between the fair market at exercise and the strike price.

1,000 X ($80.00 − $20.00) = $60,000

- Use the taxable amount calculated in step 2 to determine the income tax owed: The following tax rates are hypothetical as part of this example. Your tax rate may vary.

Federal tax = $60,000 x 22% = $13,200

Social Security tax = $60,000 x 6.2% = $3,720

Medicare tax = $60,000 x 1.45% = $870

Add these three for a total of $17,790.

- Calculate the number of shares required to perform a cashless (sell-to-cover) exercise: Divide the associated costs by the current share price.

Cost of buying the shares = $20,000 / $80 = 250 shares

Cost of paying the taxes = $17,790 / 80 = 223 shares (rounded up)

Add these two to obtain the total number of shares required, which is 473 shares.

- Calculate the number of shares remaining after the cashless sell-to-cover exercise: This equals the total shares less the figure calculated in step 4.

1,000 − 473 = 527 shares

Exploring the Post-Exercise Impact of a Cashless Exercise

In the above example, your cashless exercise of non-qualified stock options allowed you to exercise your non-qualified stock options with little to no cash outlay.

In doing so, you transitioned from controlling 1,000 options to controlling 527 actual shares. You went from having $60,000 of pre-tax value to owning $42,160 of post-tax value.

Moving forward, the remaining shares have a cost basis equal to the fair market value at exercise, ($42,160) and begin their holding period as a capital asset.

What’s the Right Choice: Cash or Cashless Exercise?

The question remains whether or not a cashless exercise of non-qualified stock options is the right choice. The truth is, there is no one, always-right answer. The real answer is something along the lines of, “it depends.”

A cashless exercise may be the best option for someone who is seeking to minimize cash outlay or is seeking to reallocate any existing company stock.

However, a cashless exercise of non-qualified stock options may not be right for someone seeking to maximize long-term appreciation via concentration risk (while retaining the associated risk) or for someone that has adequate liquidity to cover the cost.

The timing of a cashless exercise may also impact the final decision. Is this decision a forced decision due to an expiration date, or is this part of a deeper options strategy that coordinates other option grants and other option types (such as incentive stock or restricted stock)?

If you aren’t sure how to answer these questions, you may want to find someone who can help. A good financial advisor may be able to develop a plan and a strategy that integrates your cashless exercise with your overall financial plan.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. Hypothetical examples contained herein are for illustrative purposes only and do not reflect, nor attempt to predict, actual results of any investment. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

Hi, Daniel. Very clear explanation, thanks. One thing I’ve always wondered… in your example above, what happens to the $10 difference when you rounded up the number of shares you sold to cover the cost to purchase the shares and taxes? You sold 495 shares at $80 (=$39,600) but the cost of the shares and taxes was only $39,590. I perfectly understand why you need to round up to cover, but isn’t there $10 unaccounted for somewhere?

Correct – if I had rounded down, a few dollars of cash would be required to make the exercise even. Because I rounded the amount of shares up, a small amount of residual cash is likely due to the employee.

I may have to have a conversation with the brokerage that handles my options then because I checked back several exercises and they always round up and I don’t see the difference coming back to me. Is it possible they keep it and if so can that be legal?

Daniel,

I was happy to find this explanation of tax treatment in cashless exercise, thanks for publishing it!

A couple of issues:

– According to several references I find from searching (e.g. investopedia [1]), the price paid by the employee for the options is called the “exercise price”, not the “grant price”. The value when sold is “market price”, not “exercise price”.

– The calculation of tax liability is done on all 1,000 shares, even though the scenario described is that only the portion of shares required to cover the cost is sold. As I understand it, this is not correct. Unless I’m missing something, these taxes apply only to those shares which are actually sold immediately or in a timeframe that requires them to be taxed as short-term capital gains (as calculated above).

If I do have this correct, calculating the tax due and the consequent required number of shares to sell has to be done in a single formula. I’ll spare the algebraic gymnastics to arrive at the closed form, but I believe that given:

Ng = Shares granted

Po = Option price

Ps = Selling price

R = Tax rate

then number of shares to sell can be found by

Ns = (Ng * Po)/[Ps – (Ps – Po)]

For your particular example, this results in the required sale of 332 shares.

I hope you’ll let me know if I’ve gotten something very wrong. 🙂

[1] https://www.investopedia.com/articles/optioninvestor/07/esoabout.asp

Addendum:

Looking again at the investopedia link, I see that non-qualified stock options (NSO) trigger a tax event exactly as you described. Sorry for the confusion (and wishing I hadn’t burned cycles on “algebraic gymnastics”).

I have a question specific to a Cashless exercise, not through a broker. In this case, they reduced the options options (from 6,000 original they granted 1,000) to do the cashless.

In the roll-forward footnote disclosure are the 5,000 (6,000-1,000) considered Exercised or some other classification?

Hi Alejandro – Not sure I follow the details here exactly. Feel free to email me offline if you’d like to discuss a specific scenario, and I may be able to help.

Thanks

Hi Daniel,

Great article very helpful, quick question, are Cashless exercise offered to ex-employees within the 90 day window of leaving a company?

Thanks

Gary

Hi Gary

I would check with the company – I would think that they will be able to help with this question.

Hi Daniel,

Doing that in parrallel, thank you for the guidance

When I have exercised options on a cashless basis, I received the difference paid in cash between the option price at grant less the market price at time of exercise and taxes withheld. I retained no shares. In addition to federal taxes withheld, I was also subject to NY State income tax withholding since I was employed in that state when the original grants were made. Basically, the cash out was considered as deferred compensation and, as such, treated as ordinary income. I am thinking of buying the remaining options I hold and retaining those shares. Assuming I hold those shares for more than one year and ultimately sell them, will the only taxes I be liable for be federal capital gains (I.e. not FICA, OASDI and NY State) on the difference between the original grant price and the market value at time of sale? Or, when I buy the shares would I then be immediately liable for all required taxes?

Thank you, that was very helpful!

If the intention is to exercise and immediately sell all shares, is there any effective difference from a tax perspective between funding with cash vs cashless?

Generally speaking, no – If you sell the shares right when they are exercised (and we assume the shares are sold at the same price as the fair market value when they are exercised), I would expect the tax impact to be the same.

Hi- One question on the cash vs. cashless exercise.

On the cashless exercise, the employee pays taxes on the gain (stock price at exercise date less exercise price) – $60,000 in our example.

If the employee, was going to pay out of pocket for the stock option exercises ($20,000), would the tax liability still be tax rate X $60,000?

If so; from a tax perspective it looks like is more beneficial to do a cashless exercise as you are not using $20,000 (post-tax).

I appreciate your thoughts on this.

Thanks,

Maria

Hi Maria

The tax liability is pegged to the spread between the strike price and the FMV at exercise multiplied by the number of options exercised. In this example, $60,000.

This is taxable regardless of a cash exercise or a cashless exercise.